How can we start saving for college?

I was recently asked about the best ways to save for college by a family with a newborn. I was so proud of them for planning right out of the gate. They had just received a few hundred dollars from baby gifts and wanted to use the funds to start a college savings fund. The parents were not sure which type of account they should use. They had heard of 529 accounts but wondered if that was the best option for them.

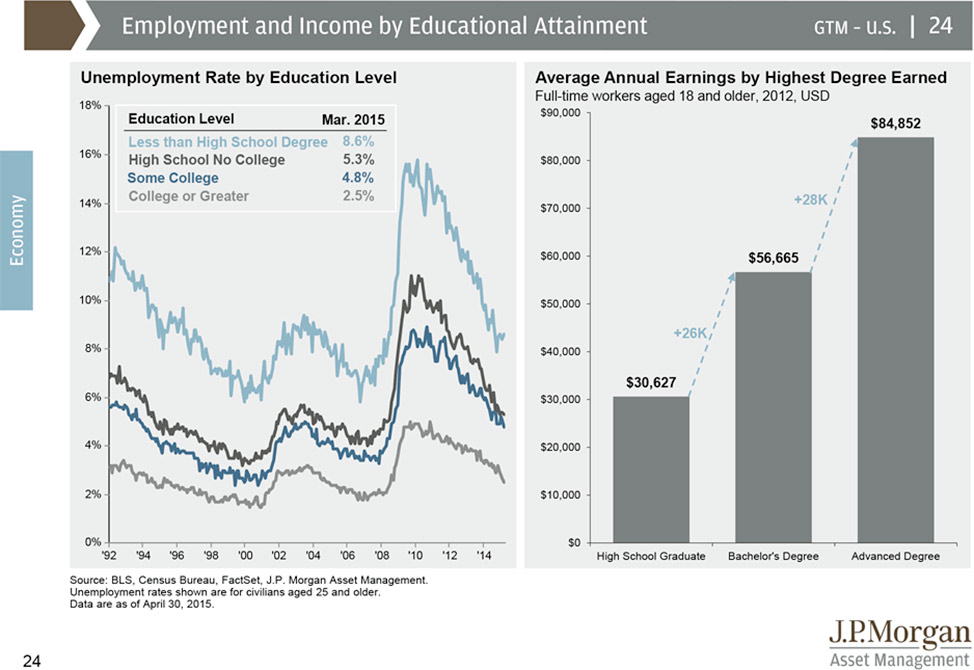

In my opinion, one thing is certain, college degrees and advanced degrees lead to greater job opportunity and higher incomes. See the graphic below by J.P. Morgan.

Two key takeaways from the graphic above. First, the higher they degree the more employable you are. You can see this in the graph in the left. The less schooling the more volatile the swing of unemployment. Second, on average, the more schooling you have the more money you make which translates to greater financial security. If you have older kids who don’t feel like going to college show them this graphic.

529 accounts provide a simple way to save for college but they are not the only option. Other options include Coverdell Accounts and Roth IRAs. I will briefly discuss each of them below and we will look at each of them in greater detail in the coming weeks.

529 Accounts

529 accounts are the most commonly used to save for college. Most states offer 529 accounts and some states even offer tax deductions for contributions to 529 accounts. Keep in mind, not all 529 plans are created equal. The costs of 529 plans vary from state to state. So, if your state does not offer a tax deduction, it may be in your best interest to use another states 529 plan in order to lower you costs. You can compare 529 plans at: www.savingforcollege.com.

I often recommend that clients use 529 accounts to save for college because the funds grow tax deferred and they can be withdrawn tax free as long as the funds are used to pay for eligible college expenses; tuition, fees, books, etc. Focus on finding a 529 plan that keeps costs down and allows you to invest in low cost exchange traded funds (ETFs) or mutual funds.

Coverdell Education Savings Account

Coverdell Education Savings accounts are limited to contributions of $2,000 per year per child. The funds must be used by age 30 and contributions cannot be made after the beneficiary’s 18th birthday. The funds get to grow tax deferred just like a 529 account but you can also use these funds for private elementary or secondary schooling; with a 529 you cannot.

Both 529s and Coverdells need to be used for education expenses to receive the benefit of tax deferred growth. If you don’t use the funds for educational purposes, the funds will be subject to a 10% tax penalty and you will pay ordinary income tax on the earnings the funds have accrued.

Roth IRAs

An alternate option to 529 and Coverdell accounts is a Roth IRA. As a parent, you could have a Roth IRA in your name and put your “education funds” in the account each year; up to $5,500 in 2015. The funds get to grow tax-free and you can take all of your contributions out the account tax-free. You can also utilize the earnings without penalty so long as you use the funds for education expenses and the account has been open for at least 5 years. If under 59 1/2, you would pay ordinary income tax on the funds though. Once you are 59 1/2 you can use the earnings for education expenses tax-free. As an additional benefit, Roth IRAs don’t count toward FAFSA calculations. Any withdrawals from the account to pay for school would count in the FAFSA calculations for the following year. Another benefit of a Roth IRA is that if your child doesn’t need the funds for education, you can continue to grow the assets tax-free for your own retirement.

Each option has its strengths and weaknesses. In the coming weeks, we will look at each one in greater detail. No matter which type of account you choose saving for college is an excellent idea. The key is to start. Once you have the account open, mention that you are saving for college to friends and family. Many families now ask for gifts to the college fund in lieu of presents for birthdays and holidays. Especially when the kids are young and the box is cooler than what’s inside.

Do you have college savings plan for your family?