6 Tips to Start Your Financial Plan

For so many young families, money and finance can feel like this ominous and intangible thing. We know we need to pay attention to our financial lives, but how do we get started? Very few of us are well versed in the language of finance and we can quickly become overwhelmed by our lack of knowledge coupled with endless choices.

“It’s not hard to make decisions when you know what your values are.” – Roy Disney

Taking a moment to get clear about your values, setting goals based on your values, and taking stock of where you stand today will help you frame your financial decisions. With this clarity, making financial decisions will become more manageable and tangible.

Figure out your why

First, take a step back and get clear about your why. Ask yourself, or have your spouse or a friend ask you: why is money important to you? Go with your gut. You’re first answer is usually the right one. Oh, and for you perfectionists out there, there is no right or wrong answer. Let’s say your answer is security. Great! Now ask: Why is security important to you? Answer and repeat until you can go no further. The farther you drill down, the harder it will get to answer the question. That’s ok, take your time.

I know…. I know… this seems a bit weird at first, but it’s not. By going through this exercise you will start to understand what you truly value. And no two people are exactly alike. Don’t believe me? When you are finished, turn around and do the same exercise with your spouse or friend. You’ll see 🙂

test

For me, I value sharing experience with my family. I am building my business purposefully in the cloud so I can work with my clients from anywhere, which will allow me to have more experiences with my family, hopefully all over the world.

Dream big

Next, think about the goals that you want to accomplish in life. This isn’t a time to second guess yourself, you can edit later. Right now just write down all of your goals and dreams and remember – dream big! If you want to get all 21st Century on this exercise make a Pinterest board.

Rocking chair test

Once you have your goals written down, do the rocking chair test. What’s that? Picture yourself sitting on a rocking chair late in life looking back on the life you have lived. Which goals and dreams were most important to you?

Was it restoring that classic car with your father and your son? Maybe it was putting your kids through college? Those 4th of July’s with the whole family at your vacation house by the beach? Review the list of goals and dreams and think about which ones matter to you most when you look back on your life. More than likely, when you go through this process you will find that the goals that truly resonate are deeply rooted in your values. You may even want to rank your goals by level of importance. This will help you focus on your most important goals first when it is time to make a plan.

Look at the big picture

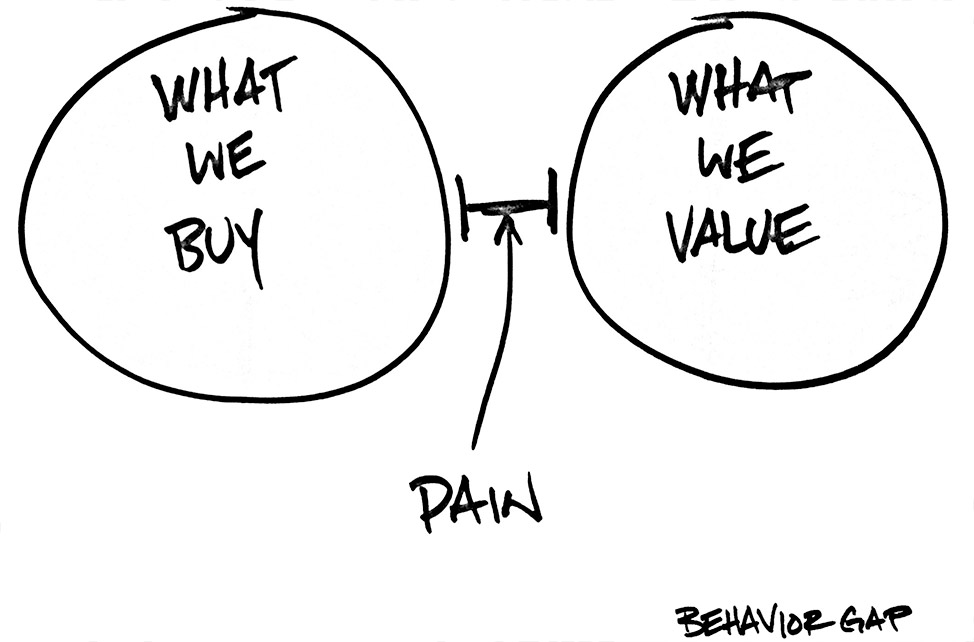

Once you know what you value and what your goals are, it is time to look at the big picture. Take a look at where you are spending your money and spending your time to see if your life aligns with your values. Carl Richard’s has written about this idea before in his New York Times column. This image of his sums up the idea nicely.

Your wallet and calendar don’t lie. Look at where you spend your money and time and see if your habits align with your values. If they don’t, you have some work to do. Guess what, we all have work to do. Taking a real hard look in the mirror and seeing that your habits don’t reflect who you want to be is not an easy process. But doing so and working toward aligning your life with your values should help you live a more meaningful life.

Know where you stand

Take account of your financial life in order to see where you stand today. Start by taking a piece of paper, drawing a line down the middle, writing down your assets (home, investment accounts, etc.) on the left and debts (student loans, mortgage, credit cards, etc.) on the right. Tally both sides up, then assets – debts = your net worth. While the number has significance, the more important thing is getting clear about where you stand. You could also use a system, like Mint, to get a sense of your financial health. This type of system allows you to check in on your net-worth real time moving forward as well.

DIY or hire some help

Once you know where you stand, it is time to make a financial plan that takes you from where you are today to where you want to be in the future. You may want to plan on your own, especially if geeking out on financial planning and investment management is something that you value. Or if you don’t have the time, willingness, or ability to manage your own financial life, you can look to hire a financial advisor to help you create a plan and hold you accountable along the way.

If you want to find an advisor, feel free to schedule a call with me here, seek out my fellow Gen X and Gen Y advisors at XY Planning Network, or find an advisor at LetsMakeaPlan.org.